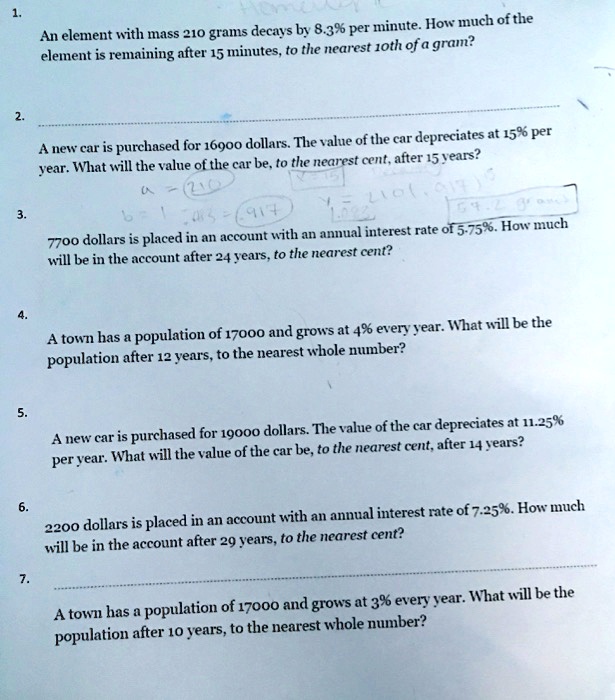

SOLVED: An element with mass 210 grams decays by 8.3% per minute: How much ofthe to the nearest 1oth of a gram? element is remaining after 15 minutes Cr 'depreciates at 15%

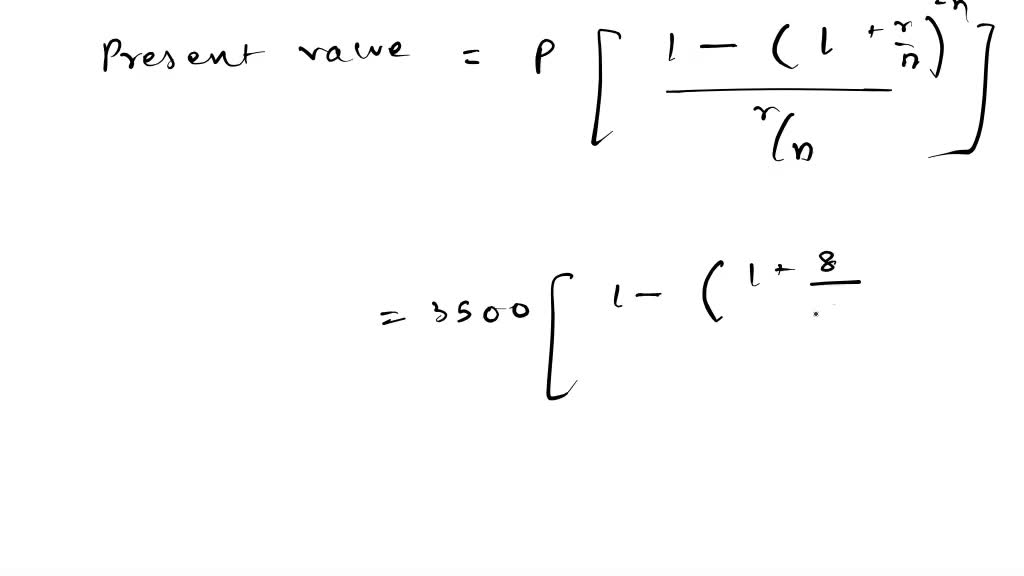

PDF) A Basic Course in the Theory of Interest and Derivatives Markets: A Preparation for the Actuarial Exam FM/2 | Jose Roberto Huerta Arriaga - Academia.edu

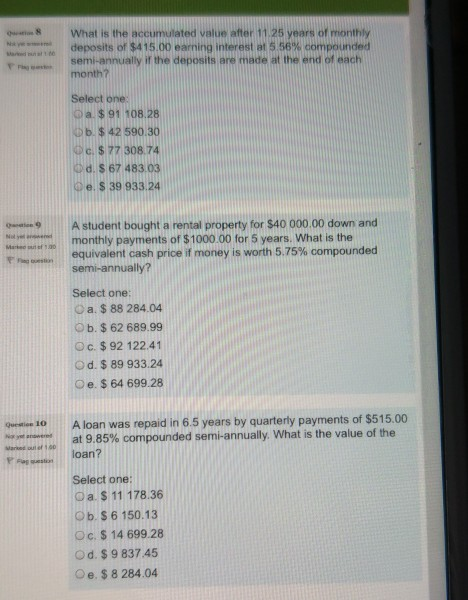

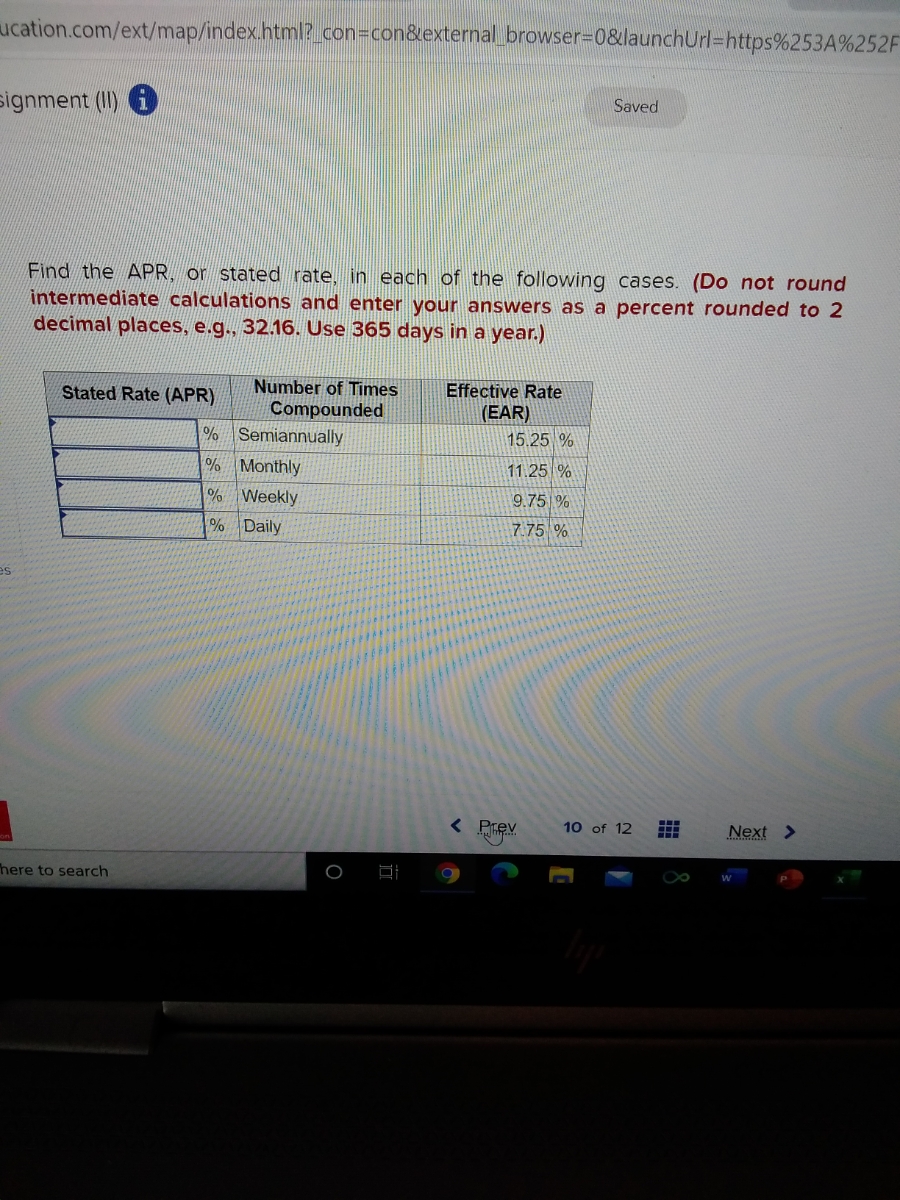

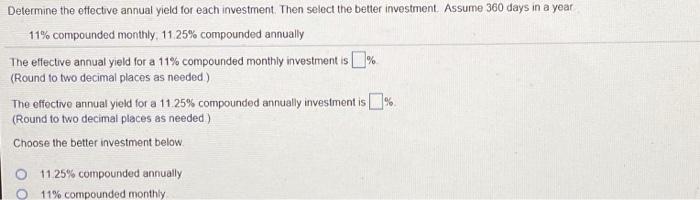

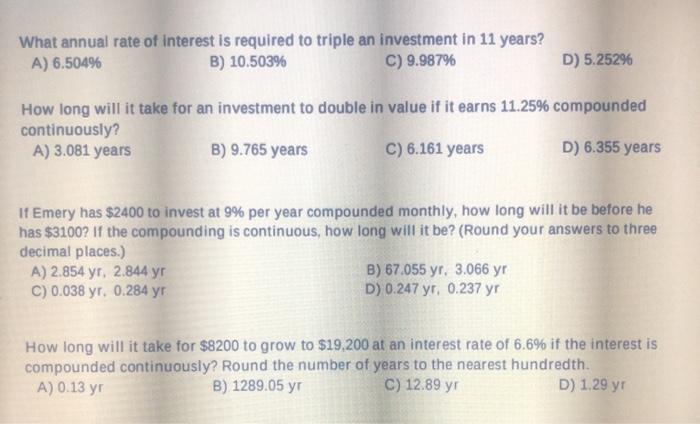

SOLVED: QUESTION 16Mark is looking to secure a small business loan. The first lender is offering 11% compounded weekly, whereas the second lender is offering 11.25% compounded semi-annually and the third lender

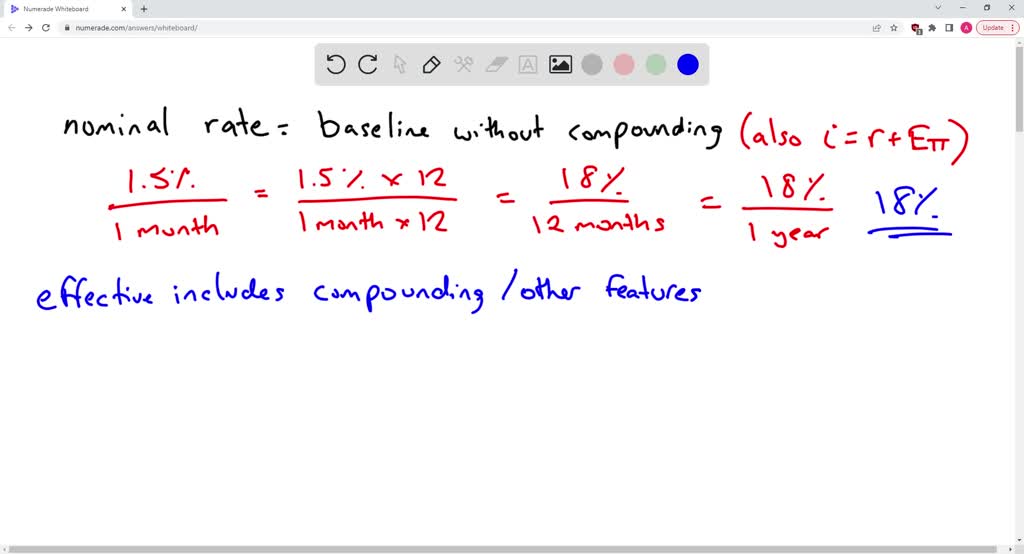

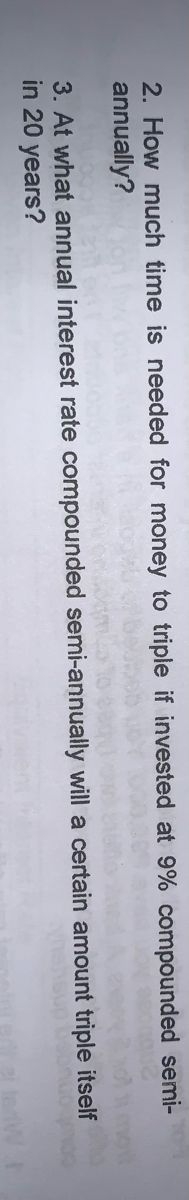

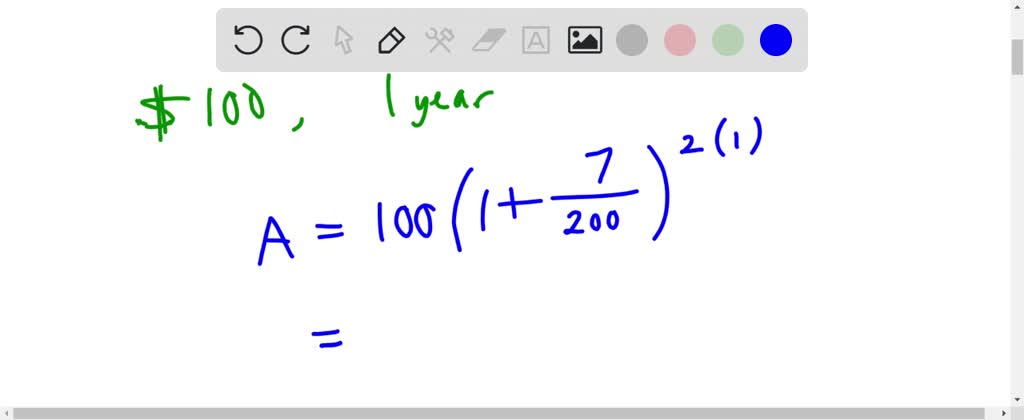

SOLVED: part 1) A passbook savings account has a rate of . Find the effective annual yield, rounded to the nearest tenth of a percent, if the interest is compounded monthly. The