Amazon.com : 12 Pack Blue Large Business Receipts & Expense Organizer Envelopes for Expense Tracker and Storing Receipts-The Front Detail is Expense Ledger to Record Business Expenses, Mileage Records on Back :

2 years of flagging a fake review from a non customer and fake profile. Nothing gets done about it. - Google Business Profile Community

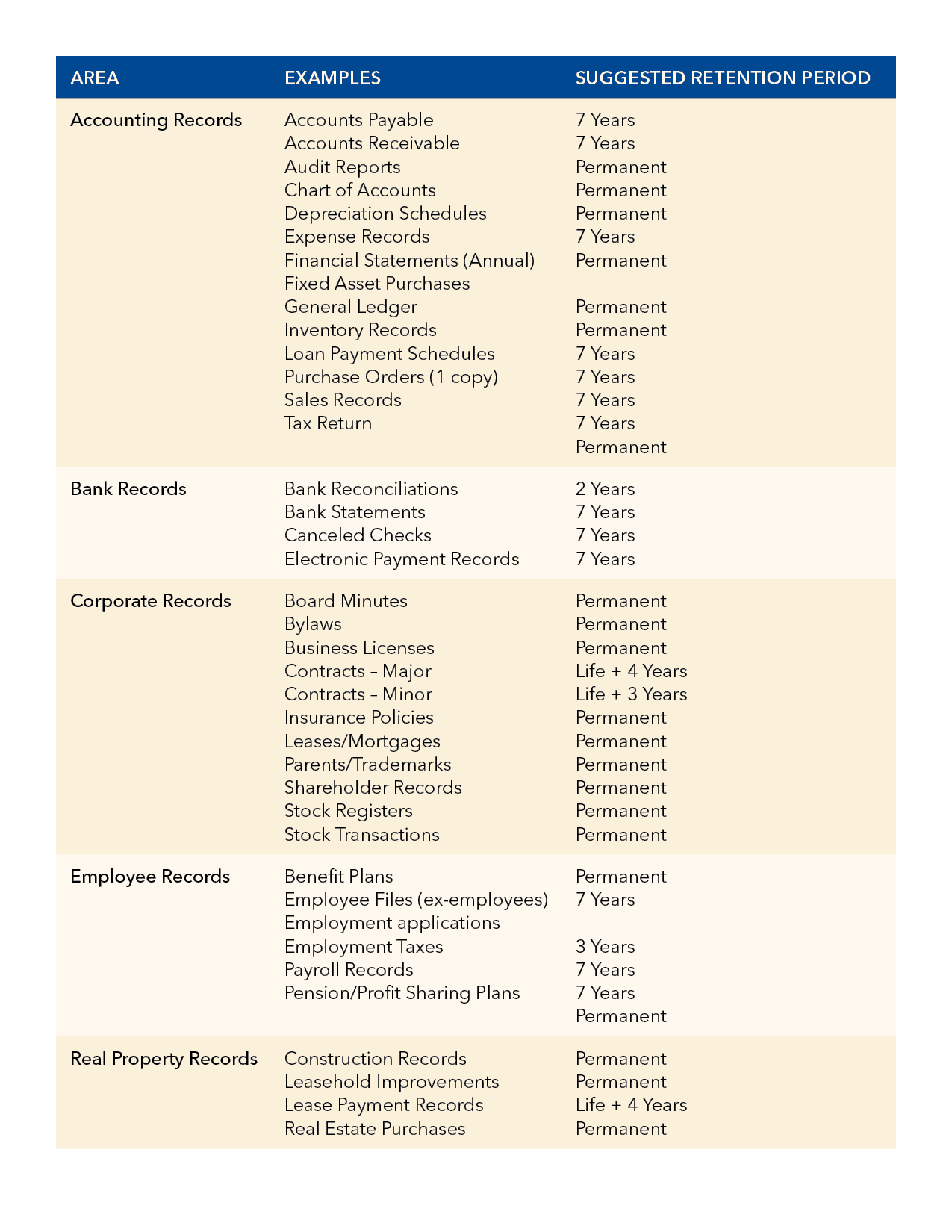

Accounts payable 7 years Accounts receivable 7 years Audit reports Permanent Chart of accounts Permanent Depreciation schedules

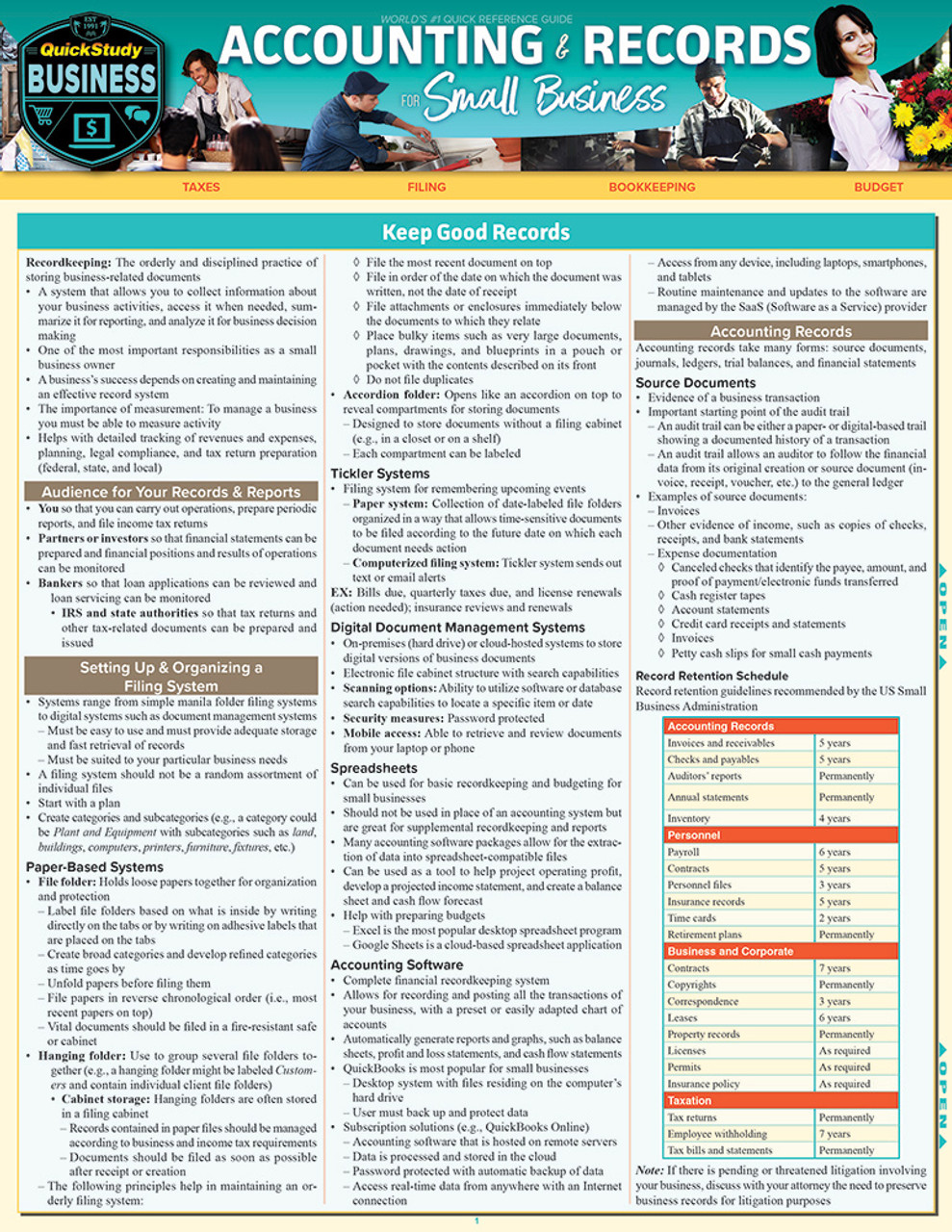

6 Types of Business Records and Receipts Every Small Business Should Keep - California Business Journal

![Florists' review [microform]. Floriculture. The Florists^ Review PiBBOAST 12, 1920. This merchant finds it easy to make out his income tax report HE has a checking account at the bank and Florists' review [microform]. Floriculture. The Florists^ Review PiBBOAST 12, 1920. This merchant finds it easy to make out his income tax report HE has a checking account at the bank and](https://c8.alamy.com/comp/RRJD2F/florists-review-microform-floriculture-the-florists-review-pibboast-12-1920-this-merchant-finds-it-easy-to-make-out-his-income-tax-report-he-has-a-checking-account-at-the-bank-and-he-uses-an-up-to-date-national-cash-register-from-his-bank-check-book-and-his-bills-he-gets-the-cost-of-running-his-store-cost-of-merchandise-bought-and-a-record-of-payments-made-from-his-national-cash-register-he-gets-a-record-of-cash-sales-2-charge-sales-d-received-on-account-0-petty-cash-paid-out-and-d-clerks-sales-these-records-give-him-control-over-his-business-every-day-of-the-year-th-RRJD2F.jpg)