Entropy | Free Full-Text | Non-Gaussian Closed Form Solutions for Geometric Average Asian Options in the Framework of Non-Extensive Statistical Mechanics

SUBLEADING CORRECTION TO THE ASIAN OPTIONS VOLATILITY IN THE BLACK–SCHOLES MODEL | International Journal of Theoretical and Applied Finance

A robust numerical solution to a time-fractional Black–Scholes equation | Advances in Continuous and Discrete Models | Full Text

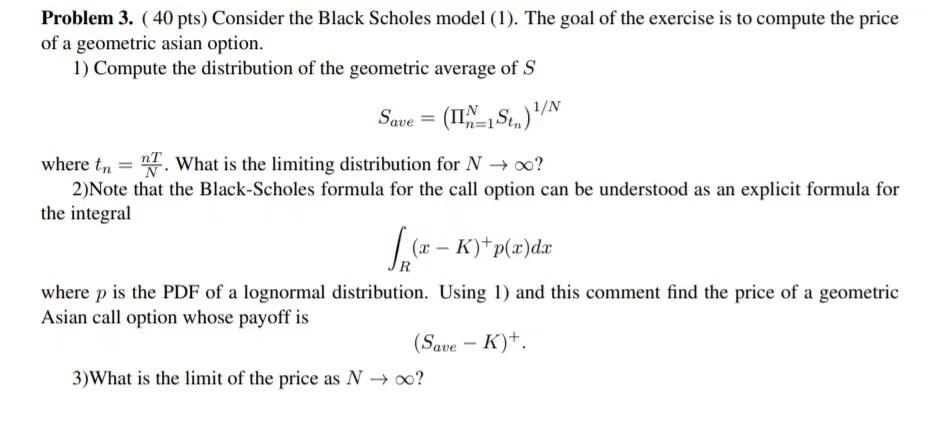

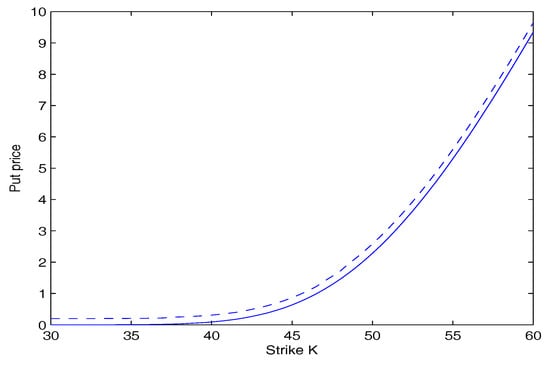

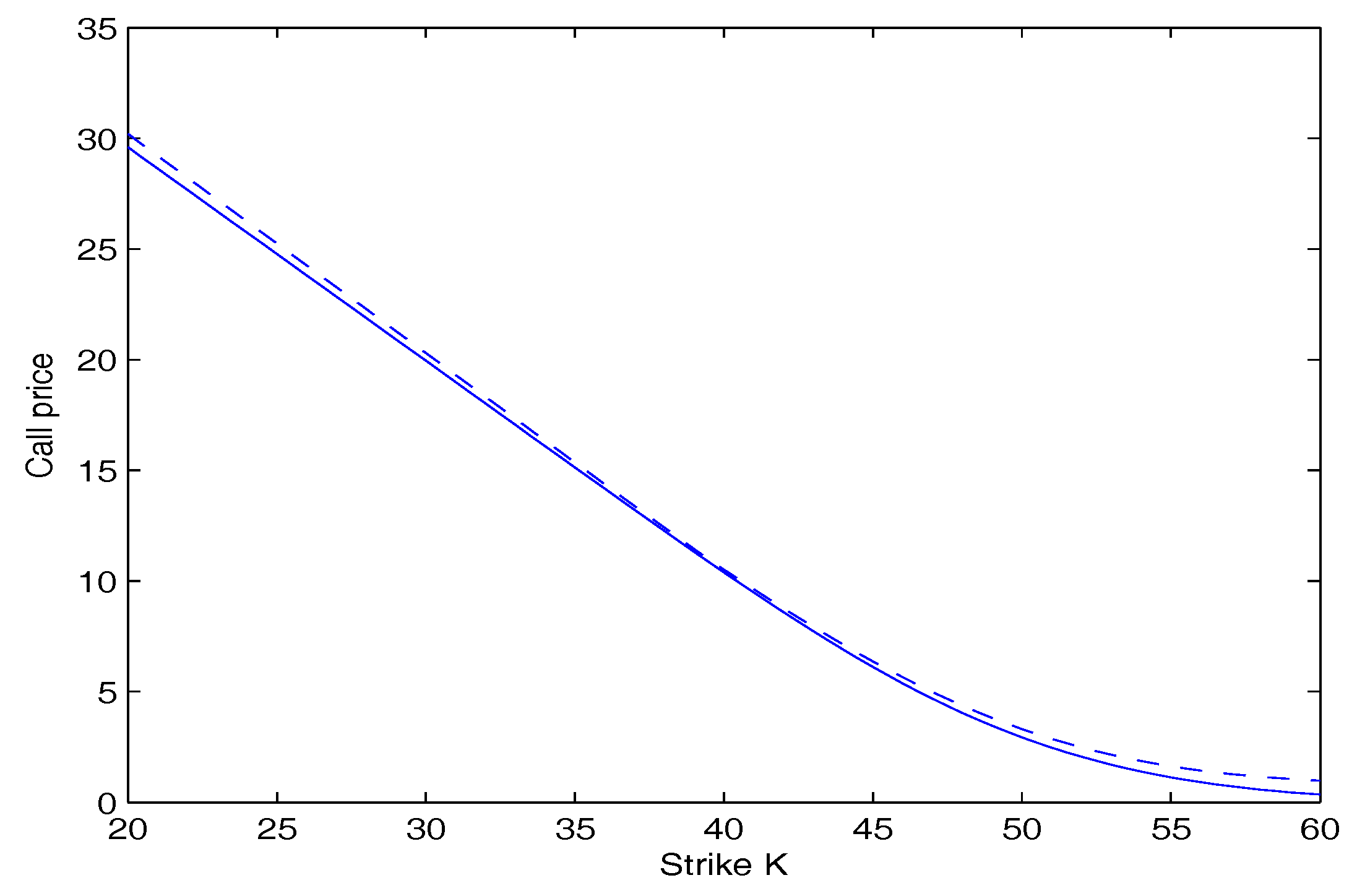

Numerical pricing of geometric asian options with barriers - Aimi - 2018 - Mathematical Methods in the Applied Sciences - Wiley Online Library

Geometric Asian Options Pricing under the Double Heston Stochastic Volatility Model with Stochastic Interest Rate

Entropy | Free Full-Text | Non-Gaussian Closed Form Solutions for Geometric Average Asian Options in the Framework of Non-Extensive Statistical Mechanics

Pricing Asian power options under jump-fraction process | Journal of Economics, Finance and Administrative Science

Entropy | Free Full-Text | Non-Gaussian Closed Form Solutions for Geometric Average Asian Options in the Framework of Non-Extensive Statistical Mechanics

Pricing and hedging of arithmetic Asian options via the Edgeworth series expansion approach – topic of research paper in Mathematics. Download scholarly article PDF and read for free on CyberLeninka open science

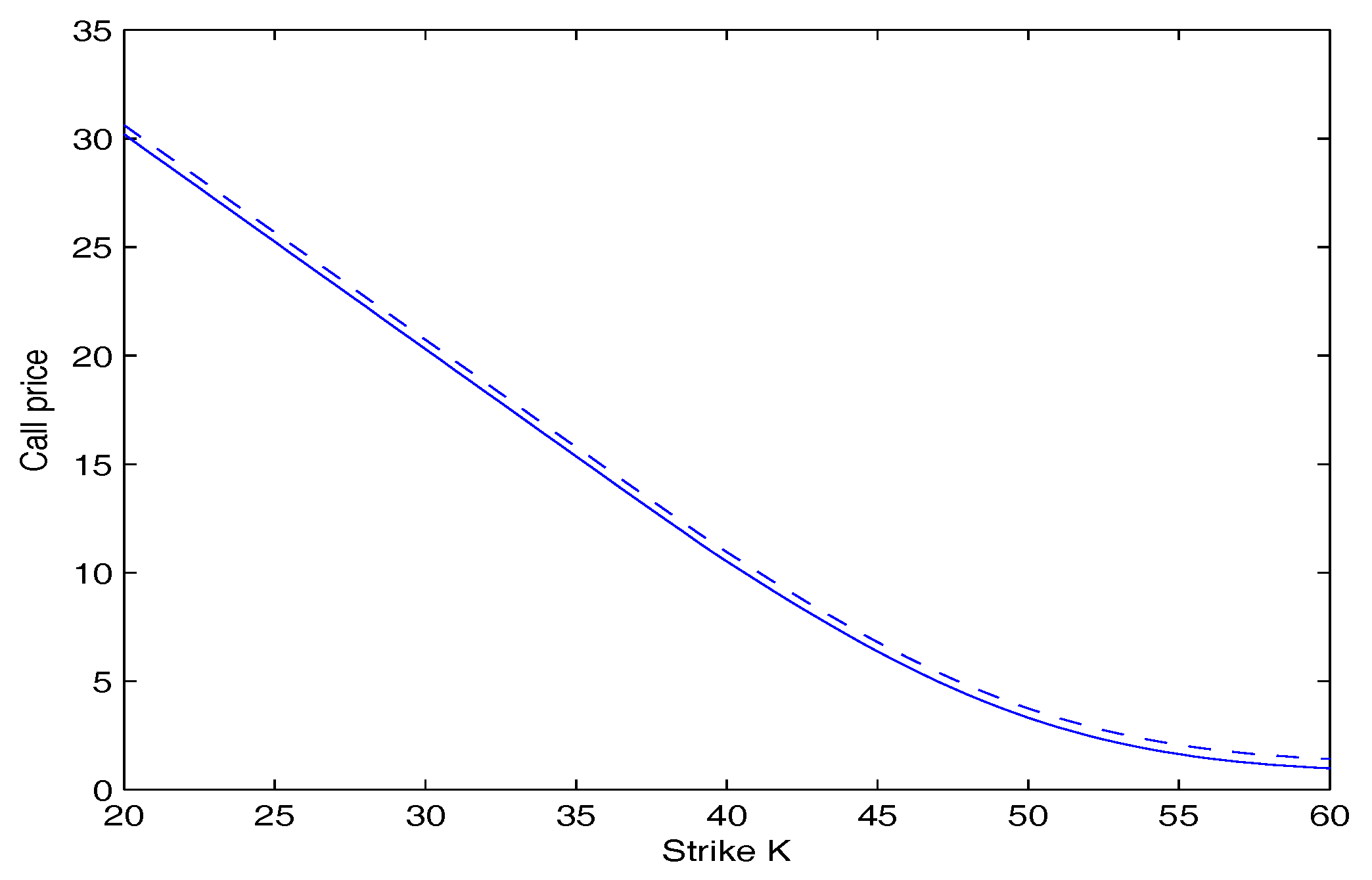

![PDF] Option pricing formulas based on a non-Gaussian stock price model. | Semantic Scholar PDF] Option pricing formulas based on a non-Gaussian stock price model. | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/6498f25b1e12b0949c2c03033ef871dbe520020c/12-Figure4-1.png)