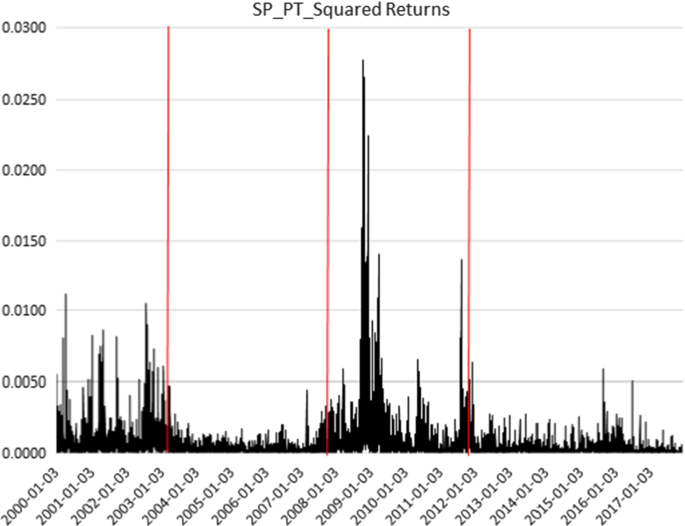

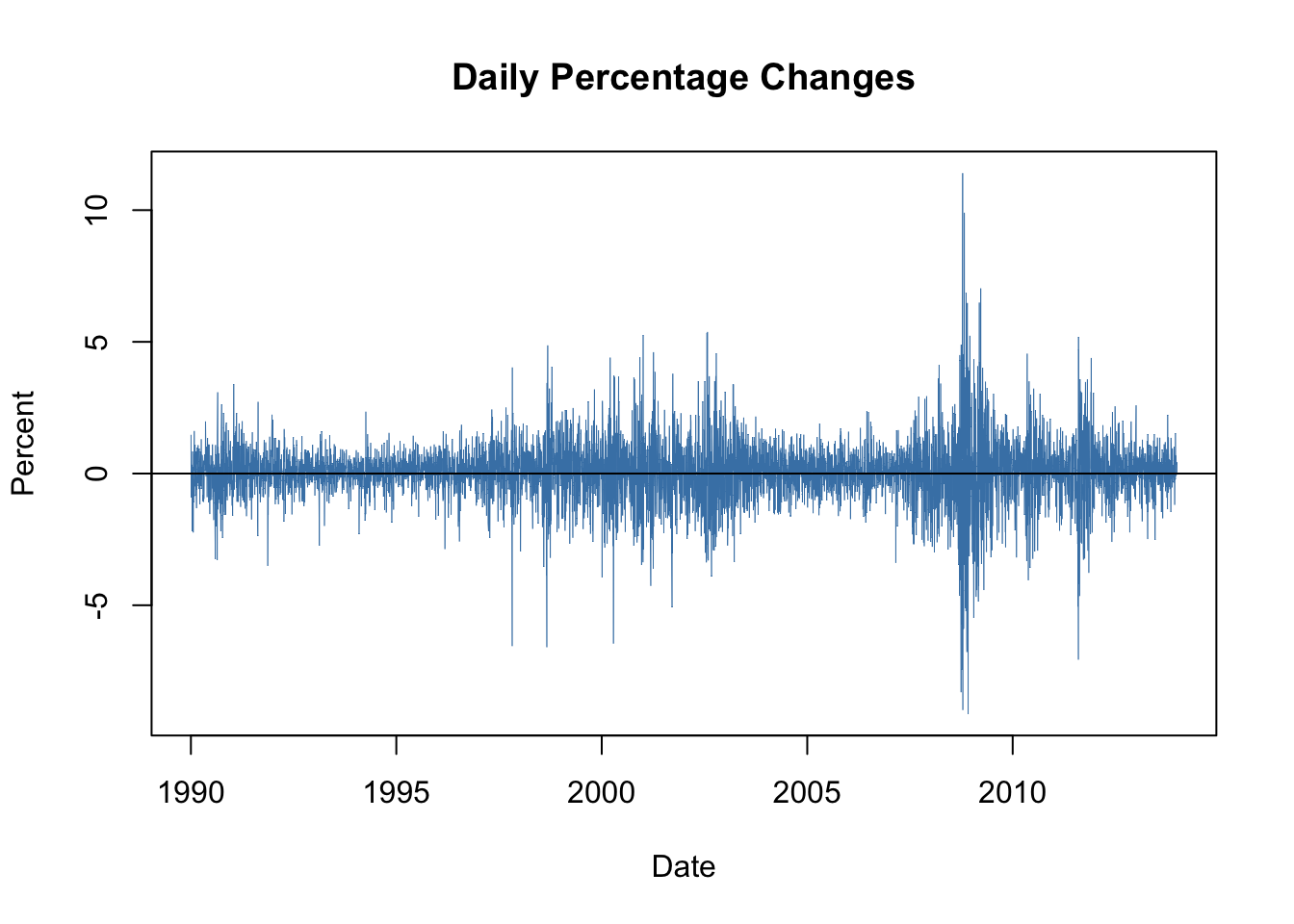

modeling conditional covariances with economic information instruments, 16.4 Clustering and Autoregressive Conditional Heteroskedasticity | Introduction Econometrics - hadleysocimi.com

modeling conditional covariances with economic information instruments, 16.4 Clustering and Autoregressive Conditional Heteroskedasticity | Introduction Econometrics - hadleysocimi.com

modeling conditional covariances with economic information instruments, 16.4 Clustering and Autoregressive Conditional Heteroskedasticity | Introduction Econometrics - hadleysocimi.com

PDF) Modelling and Forecasting Conditional Covariances: DCC and Multivariate GARCH | michelle mangwanya - Academia.edu

:max_bytes(150000):strip_icc()/Variance-CovarianceMethod5-5bde86ce7819405ca63f26aa275a4bd2.png)

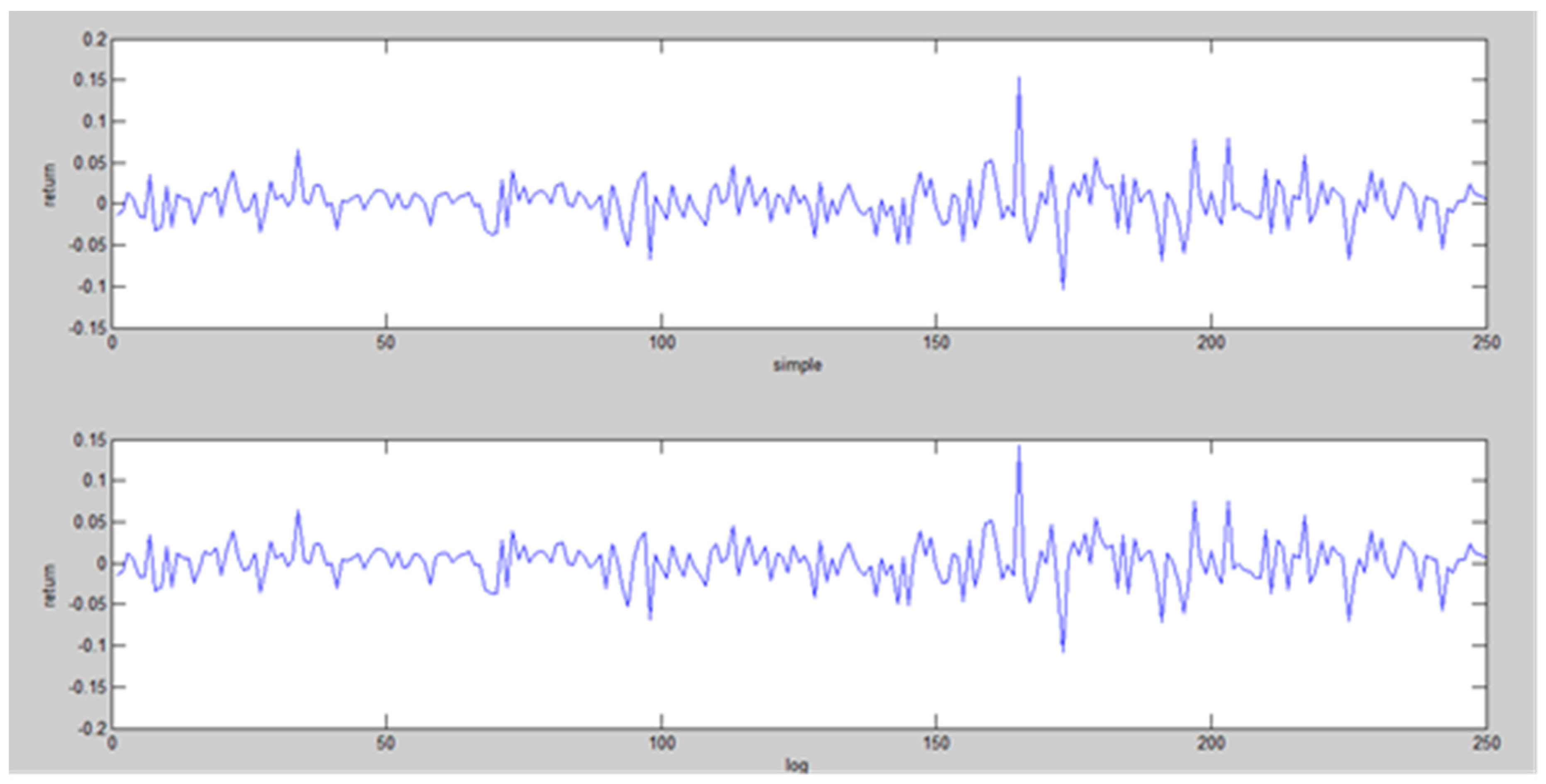

modeling conditional covariances with economic information instruments, 16.4 Clustering and Autoregressive Conditional Heteroskedasticity | Introduction Econometrics - hadleysocimi.com

modeling conditional covariances with economic information instruments, 16.4 Clustering and Autoregressive Conditional Heteroskedasticity | Introduction Econometrics - hadleysocimi.com

PDF) Forecasting Correlation and Covariance with a Range-Based Dynamic Conditional Correlation Model

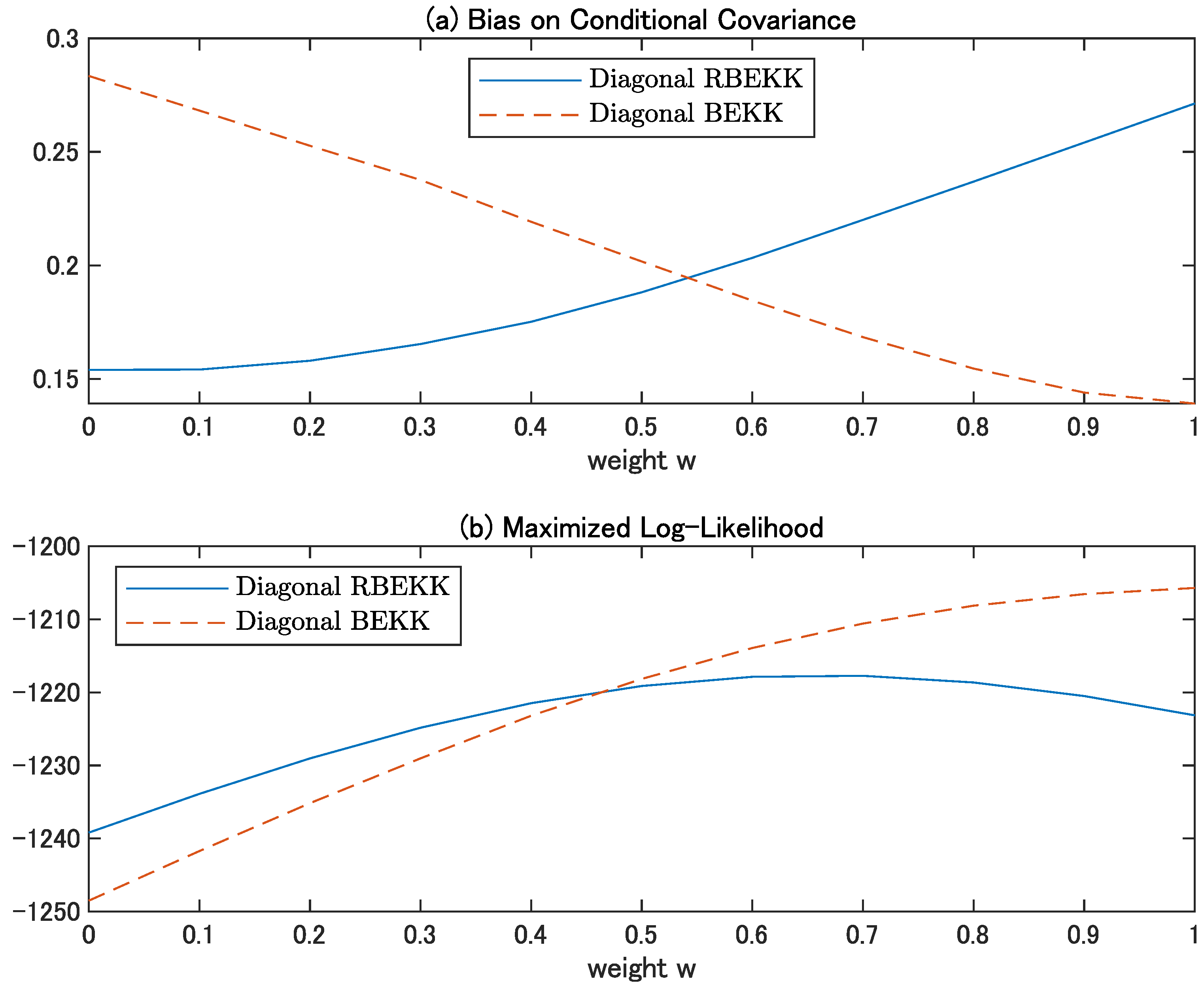

Symmetry | Free Full-Text | High-Dimensional Conditional Covariance Matrices Estimation Using a Factor-GARCH Model | HTML

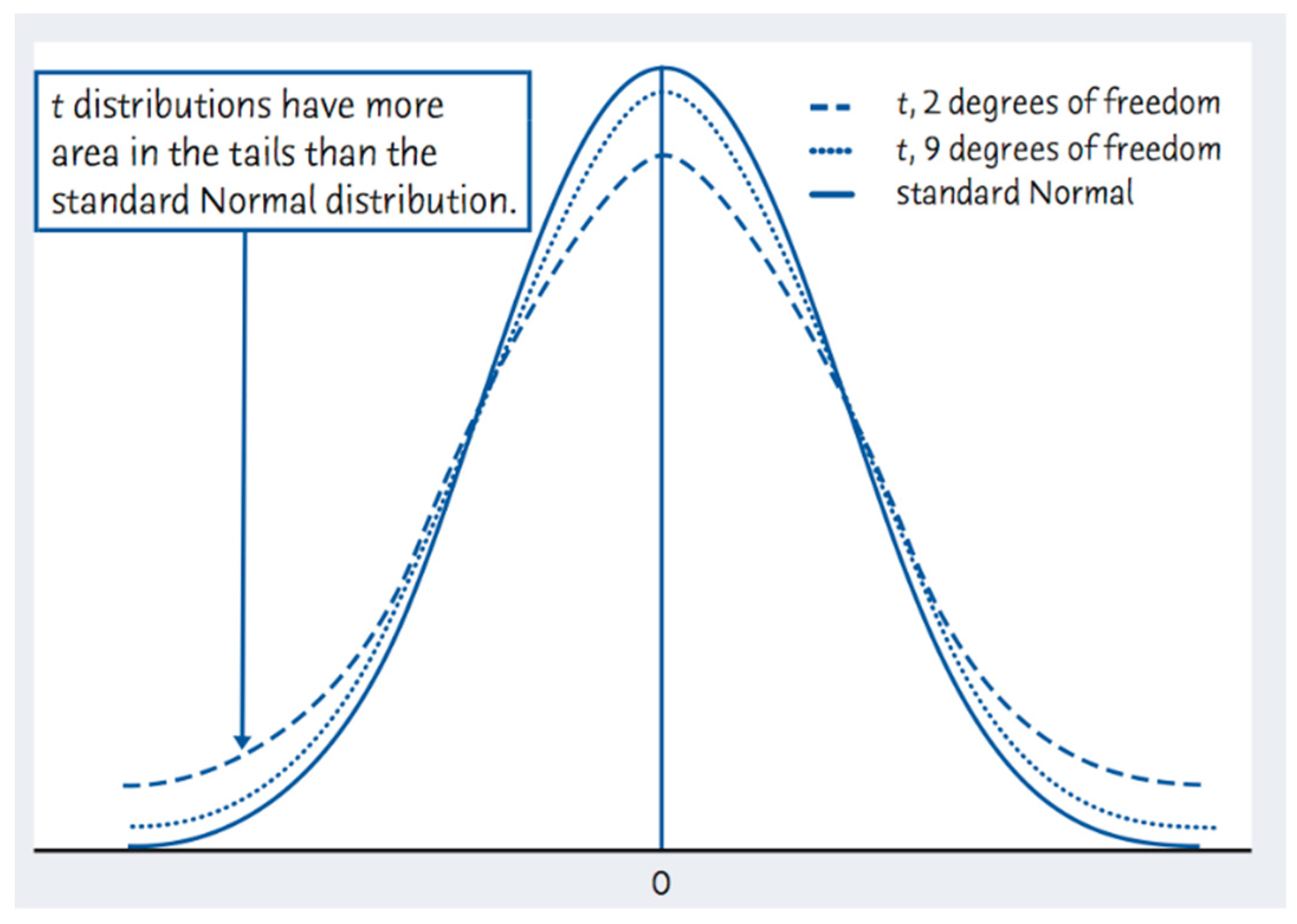

modeling conditional covariances with economic information instruments, 16.4 Clustering and Autoregressive Conditional Heteroskedasticity | Introduction Econometrics - hadleysocimi.com

JRFM | Free Full-Text | Improved Covariance Matrix Estimation for Portfolio Risk Measurement: A Review | HTML

Dynamical differential covariance recovers directional network structure in multiscale neural systems | PNAS

JRFM | Free Full-Text | Improved Covariance Matrix Estimation for Portfolio Risk Measurement: A Review | HTML

modeling conditional covariances with economic information instruments, 16.4 Clustering and Autoregressive Conditional Heteroskedasticity | Introduction Econometrics - hadleysocimi.com

modeling conditional covariances with economic information instruments, 16.4 Clustering and Autoregressive Conditional Heteroskedasticity | Introduction Econometrics - hadleysocimi.com

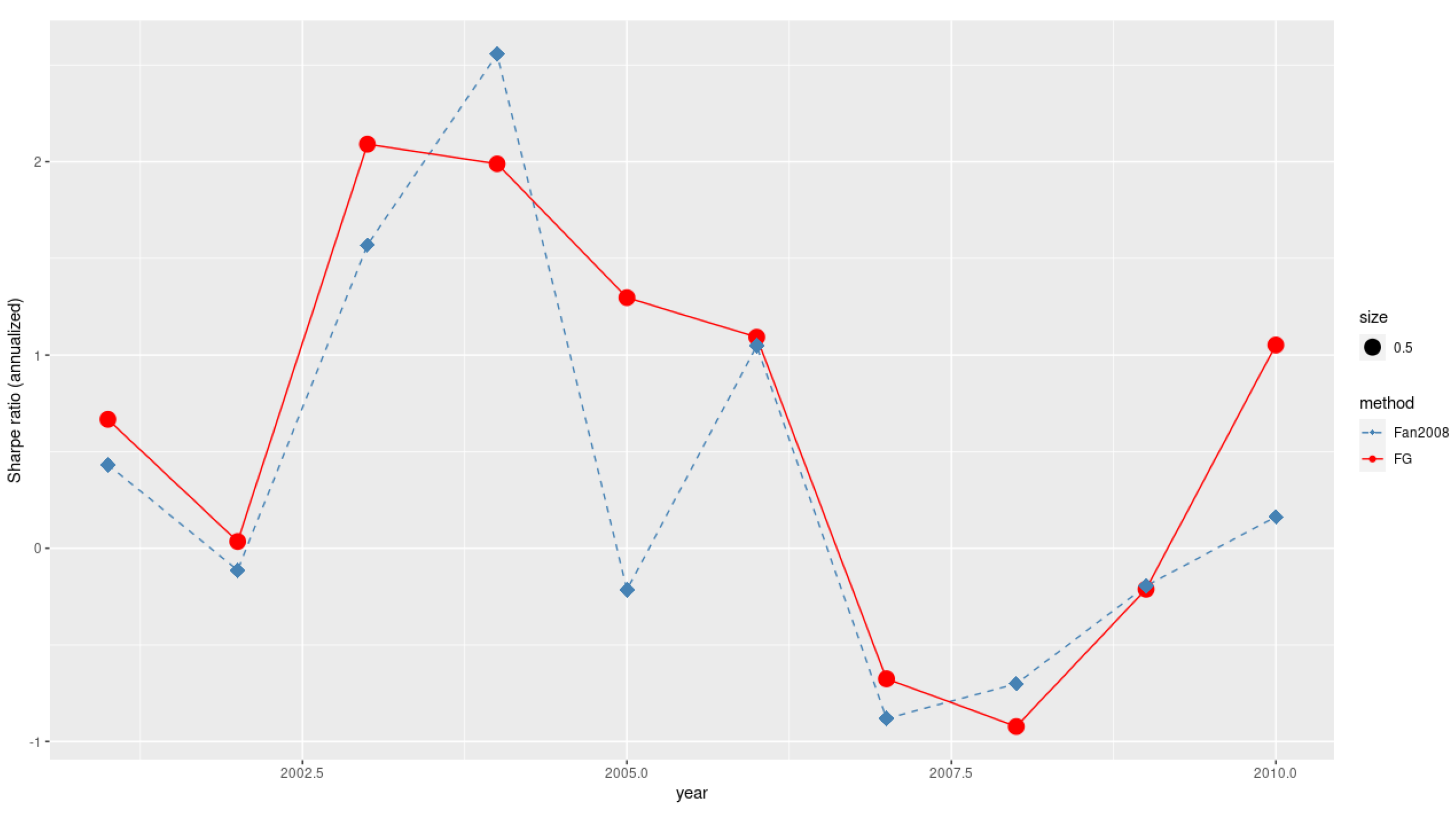

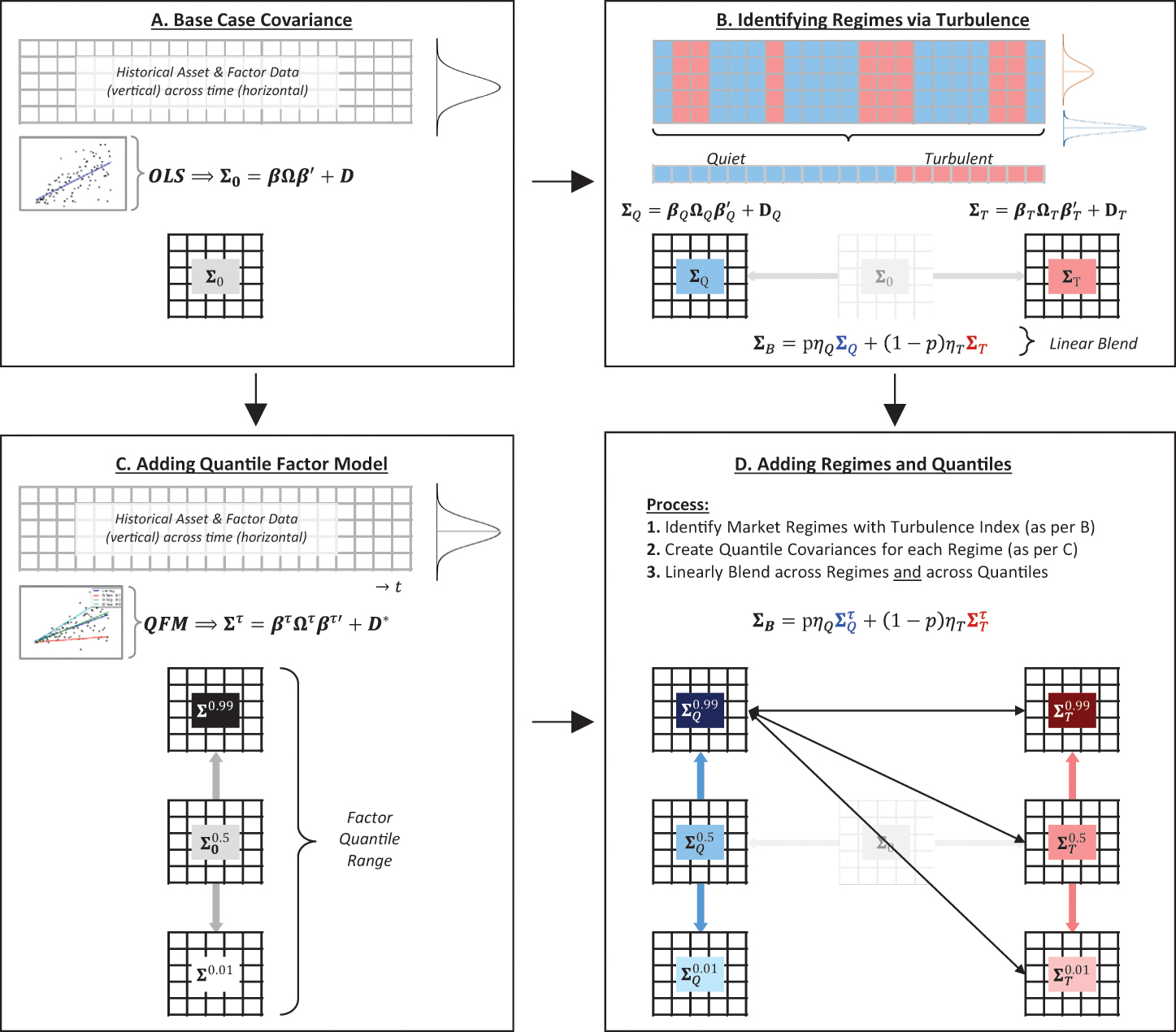

Extending risk budgeting for market regimes and quantile factor models - Journal of Investment Strategies

PDF) A Multivariate Generalized Autoregressive Conditional Heteroscedasticity Model With Time-Varying Correlations

modeling conditional covariances with economic information instruments, 16.4 Clustering and Autoregressive Conditional Heteroskedasticity | Introduction Econometrics - hadleysocimi.com

The conditional Fama-French model and endogenous illiquidity: A robust instrumental variables test | PLOS ONE