Building BDT model in EXCEL - How to utilize the results of a BDT interest rate model: Derivation of Short Rates - FinanceTrainingCourse.com

PDF) The Volatility of Short-Term Interest Rates: An Empirical Comparison of Alternative Models of the Term Structure of Interest Rates

Modelling Short Term Interest Rate Volatility with Time Series Model A Case of Pakistani Financial Markets | SpringerLink

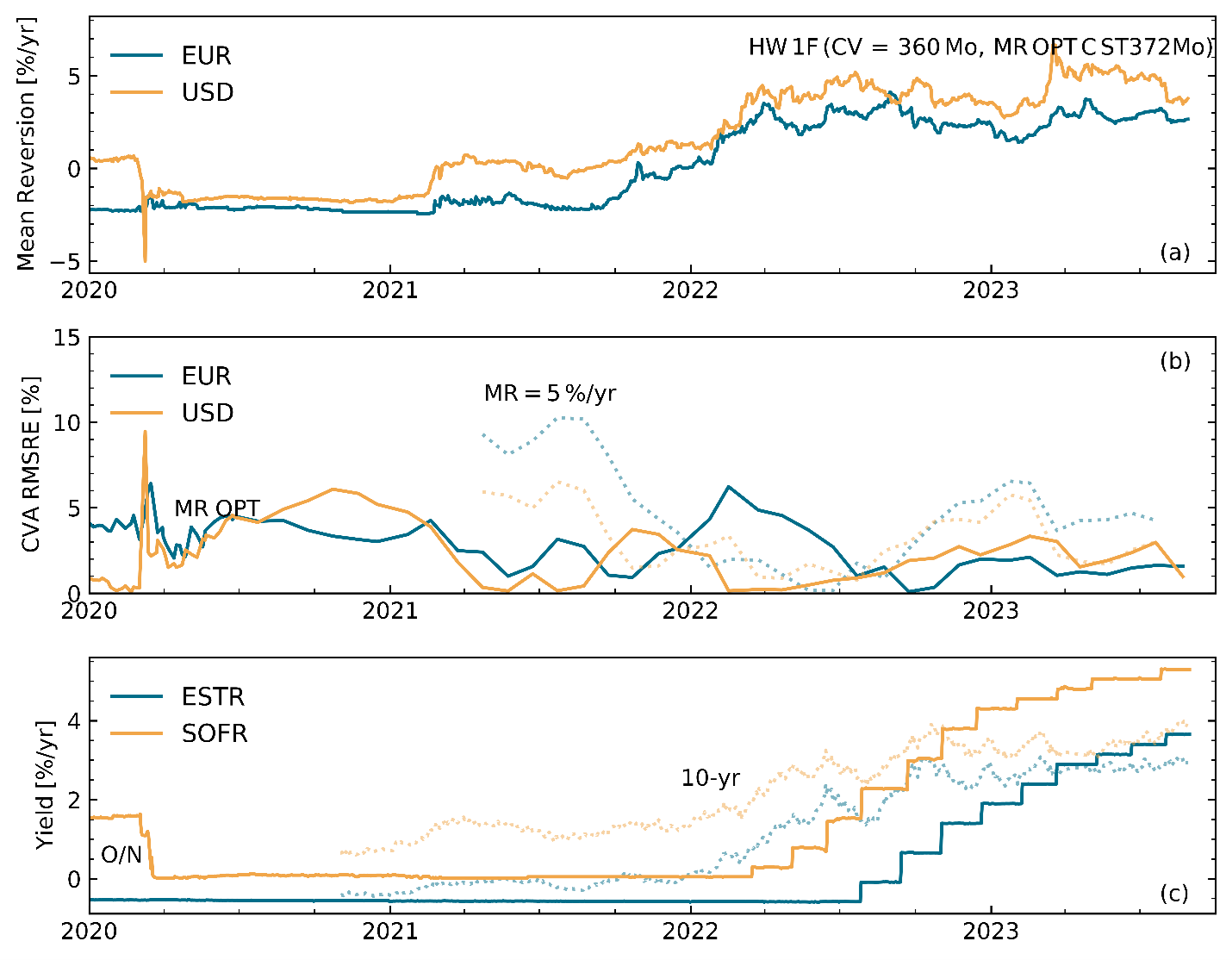

Implied Interest Rate Volatility and XVA: How the One-Factor Hull-White Model is Weathering Changing Markets | S&P Global

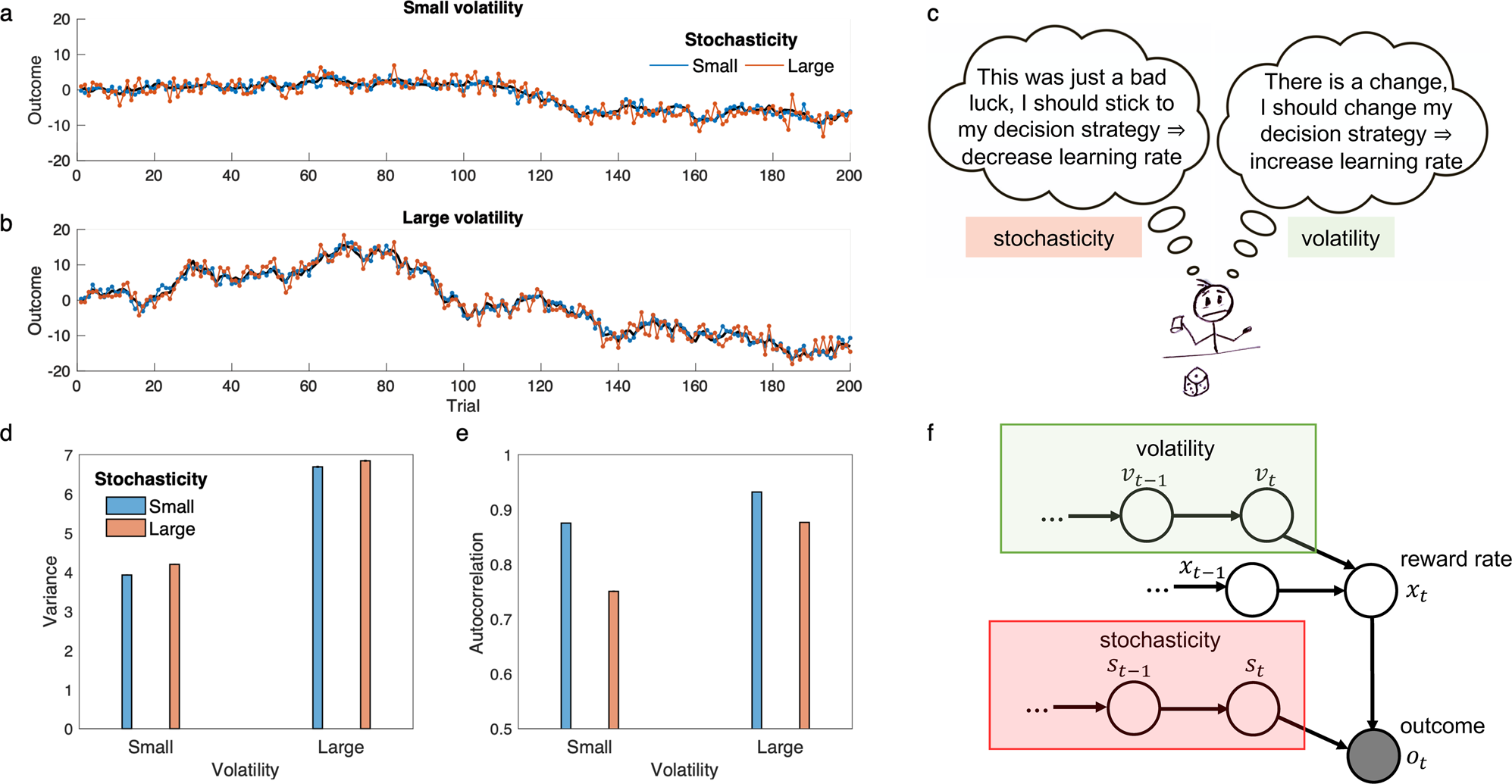

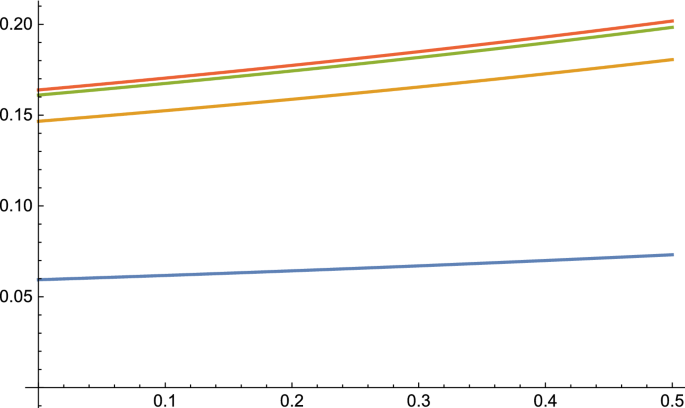

Forecast of weekly ex post volatility of short term interest rate using... | Download Scientific Diagram

Volatility dynamics of the short rate. The figure plots the volatility... | Download Scientific Diagram

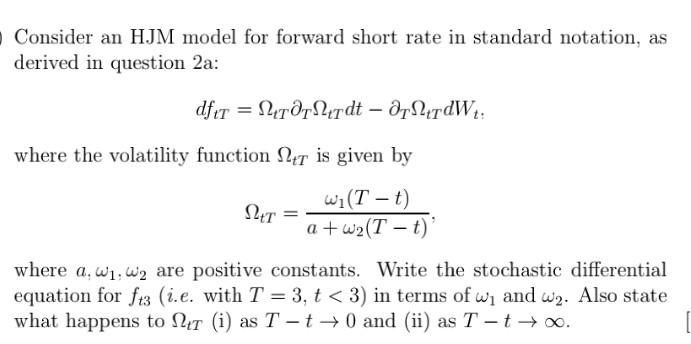

![PDF] On the Cheyette short rate model with stochastic volatility | Semantic Scholar PDF] On the Cheyette short rate model with stochastic volatility | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/48c147b4c97bce731911205d50461b168dbce33f/44-Table4.3-1.png)

![PDF] On the Cheyette short rate model with stochastic volatility | Semantic Scholar PDF] On the Cheyette short rate model with stochastic volatility | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/48c147b4c97bce731911205d50461b168dbce33f/42-Table4.1-1.png)

:max_bytes(150000):strip_icc()/Volatility-89fb205b705c493ba02c00a3fc4964cd.jpg)