Journalize transactions for XYZ Enterprises for Oct. for the current year Oct. was the first month of business for this sole prop. company Post all of the journal entries to T Accounts.

PSA L&P - Journal Entries: How to record a deposit to or a withdrawal from a savings account, or an electronic funds transfer between bank accounts – ParishSOFT

Solved] Journalise the following transactions (10 Marks) 1. Rajasaheb started business with cash Rs. 85,000 and furniture Rs. 15,000. Goods Purchase... | Course Hero

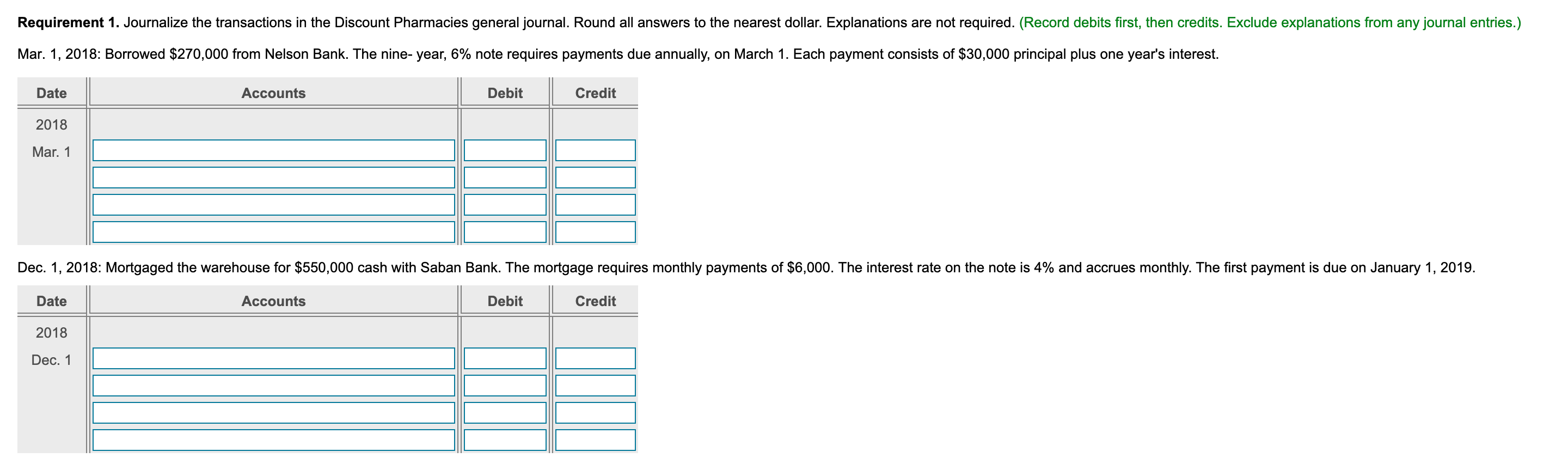

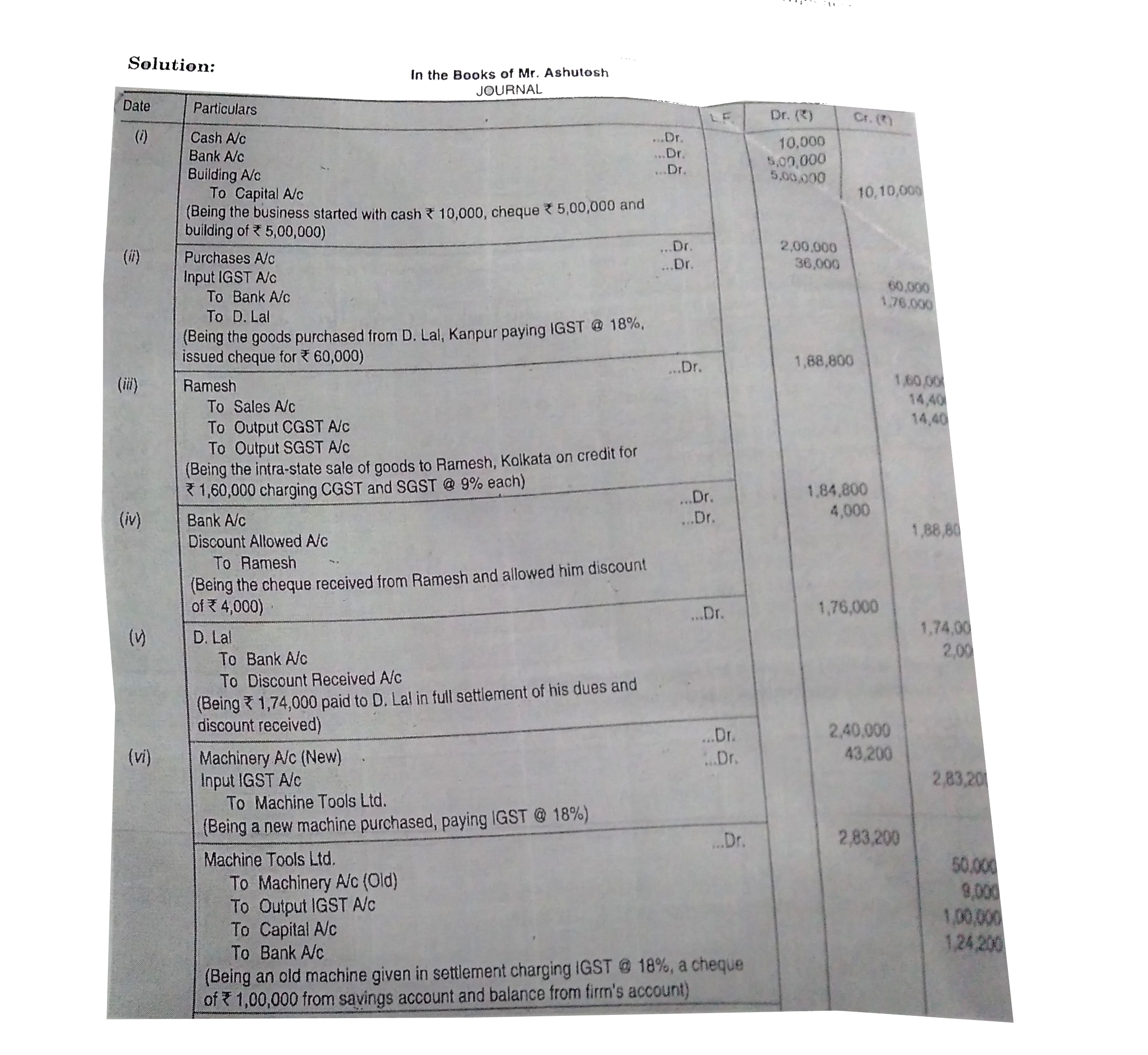

Journalise the following transactions in the books of Ashutosh, Kolkata: (i) He started business contributing Rs. 10, 000 in cash, Rs. 5,00,000 in cheque and a building valued at Rs. 5,00,000. (ii)